Discover the Leading AI Stock Pick at 33% OFF: Now Only $9.99 (originally $14.99). Enjoy monthly picks, ad-free browsing, and a 30-day money-back guarantee.

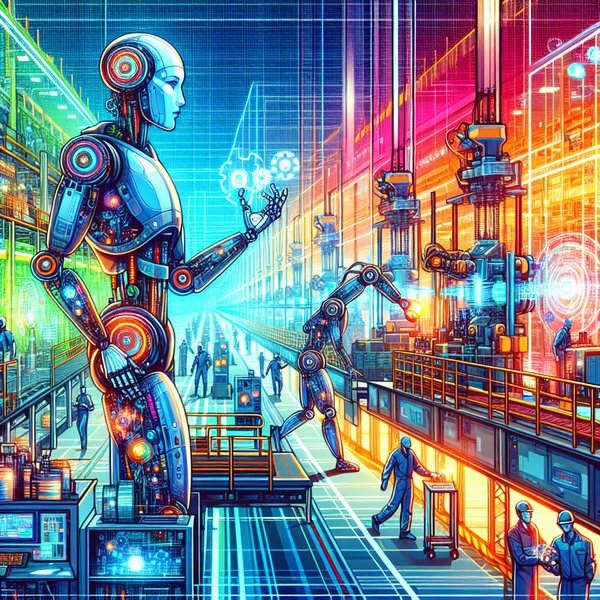

In a recent compilation of the 10 Cheap Robotics Stocks worth investing in, focus has shifted towards the growth of the robotics industry, particularly with the integration of AI technology. An upsurge in the demand for robotics is evident as market expectations soar. For instance, Goldman Sachs projects that the total addressable market for humanoid robots will boom to $38 billion by 2035, a significant increase from previous projections.

Professional service robots have also witnessed a spike in sales, with a notable interest in transportation, logistics, and medical sectors. The adoption of robotics is not region-specific, as sales have surged globally, with Asia-Pacific leading the charge. Countries like the United States, China, and Germany are at the forefront of robotics manufacturing, with notable investments in automation and industrial robot installations.

ETFs such as Global X Robotics & Artificial Intelligence (BOTZ) and Robo Global Robotics and Automation Index (ROBO) have shown promising returns, reflecting the growing appeal of robotics stocks among investors. The rising demand for automation systems and humanoid robots underscores the potential for growth in this sector.

When considering investing in cheap robotics stocks, the focus is on companies deemed undervalued by Wall Street analysts and poised for significant growth. NVIDIA Corporation emerges as a standout player in the field of AI technology, with its innovative solutions catering to autonomous machines and AI-enabled robots. NVIDIA’s advanced technology is revolutionizing the market by enabling robots to perform complex tasks with precision.

With the increasing demand for AI-enabled robots, NVIDIA’s offerings, such as the Isaac GR00T Blueprint, are set to drive further growth in the industry. NVIDIA’s strategic position in the evolving robotics market makes it a top choice for investors seeking exposure to this lucrative sector.

Ultimately, NVDA’s position as a top player in the field of robotics and AI presents a compelling investment opportunity. However, investors looking for an AI stock with even greater potential for returns may find value in exploring other options within the sector.

For further insights on AI stocks and wide moat stocks to consider, consult our exclusive reports. Stay informed with the latest market trends and investment opportunities delivered straight to your inbox.